🚨Are ETF Approvals Coming Wednesday?

In this edition we explore the Jupiter Protocol, ETF anticipation, a F1 crypto deal, the Orbit Chain exploit and more.

🪙 Altcoins with Shoal Research

This week, we dive into the Jupiter Protocol.

Keywords

DEX: a decentralized exchange where buyers and sellers connect and transact directly to one another instead of through a broker.

DEX Aggregator: a protocol that routes trades to the DEX offering best execution (buy or sell) pricing.

DCAing: an investment strategy that buys an asset over a set period of time which allows you to get the dollar cost average over the time period (ex. $10 a month for 12 months).

What is it?

The Jupiter Exchange is a DEX aggregator for the Solana ecosystem. The Jupiter Exchange could be compared to the well known Ethereum DEX aggregator, 1inch.

What does it do?

The Jupiter Exchange routes trades to find the best execution price with an uncomplicated UX/UI making it accessible to traders of all skill levels.

What does it mean?

The protocol lets traders engage with a single platform and get the best execution price. Because Solana is cheap and fast, Jupiter allows trading features not typically available on networks like Ethereum. One of these features is DCAing, or dollar cost averaging.

Why is it interesting?

The Solana ecosystem is growing very fast, and Jupiter is launching a token this month with an airdrop.

More Information

Jupiter exchange reaches all time high

Check out Shoal Research’s Substack and Telegram channel.

🚀ETF Anticipation Building

On Friday, a series of events invigorated discussion surrounding a Bitcoin spot ETF. To begin, 11 firms submitted 19-b4 forms, which proposes a rule change that would allow for a spot Bitcoin ETF. Shortly after, rumours circulated claiming that all S-1 forms, which are the filing requesting a new security, are due Monday at 8am EST. Following this, Better Markets, a nonprofit focused on secure financial systems, released a comment letter arguing that the Security and Exchange Commission should deny the ETF. Then, on Saturday, Fox Business reported that BlackRock expects an approval by Wednesday.

👀 Arbitrum DEX Volume Exceeds Ethereum and Solana

On January 3rd, Arbitrum surpassed both Ethereum and Solana in daily DEX volume. Ethereum has traditionally maintained the highest 24-hour volume, but was overtaken by Solana for a few days in December. Now, Arbitrum, a layer 2 scaling solution for Ethereum, received $1.83 billion in transactions in 24 hours, higher than both Ethereum and Solana.

🏎️F1 Team Makes Crypto Deal

F1 teams have a history of working with crypto companies including crypto.com, Bybit and FTX. In early January, Sauber, the Formula 1 racing team, signed a two-year partnership with Stake. Stake is a crypto casino and sports betting platform. The platform secured the naming rights to the F1 team, which is now known as Stake F1 Team Kick Sauber.

⛓️Orbit Chain Exploit

On December 31st, Orbit Chain confirmed an exploit on their cross-chain bridge. Orbit Chain is a cross-chain project created in 2018. The funds drained totalled approximately $81 million USD. The project Tweeted:

“From the moment of the attack, we have been closely cooperating with both domestic and international law enforcement and security experts”.

The funds have not moved from the hackers wallets since being transferred off the chain.

📚 N+1 Recommendations

The N+1 reading and media recommendations are sourced from our team of experts and offer weekly suggestions for learning more about blockchain, crypto, finance and technology.

This weeks recommendation: The Fourth Industrial Revolution by Klaus Schwab

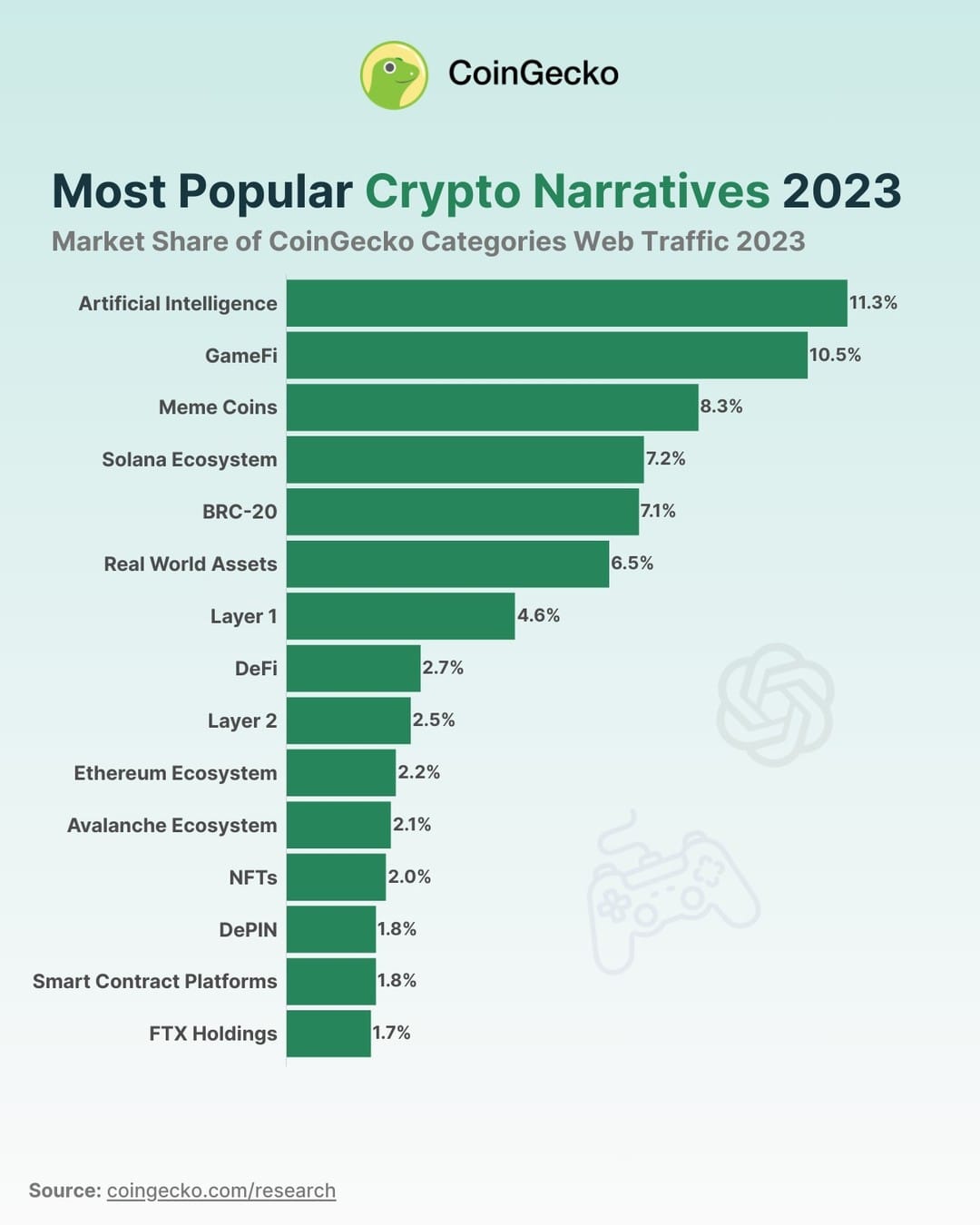

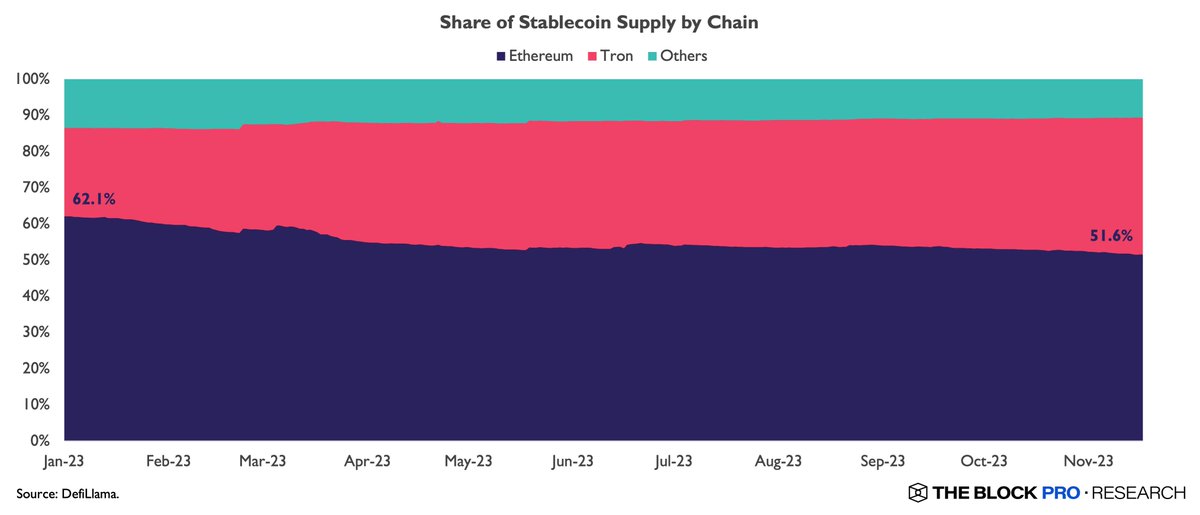

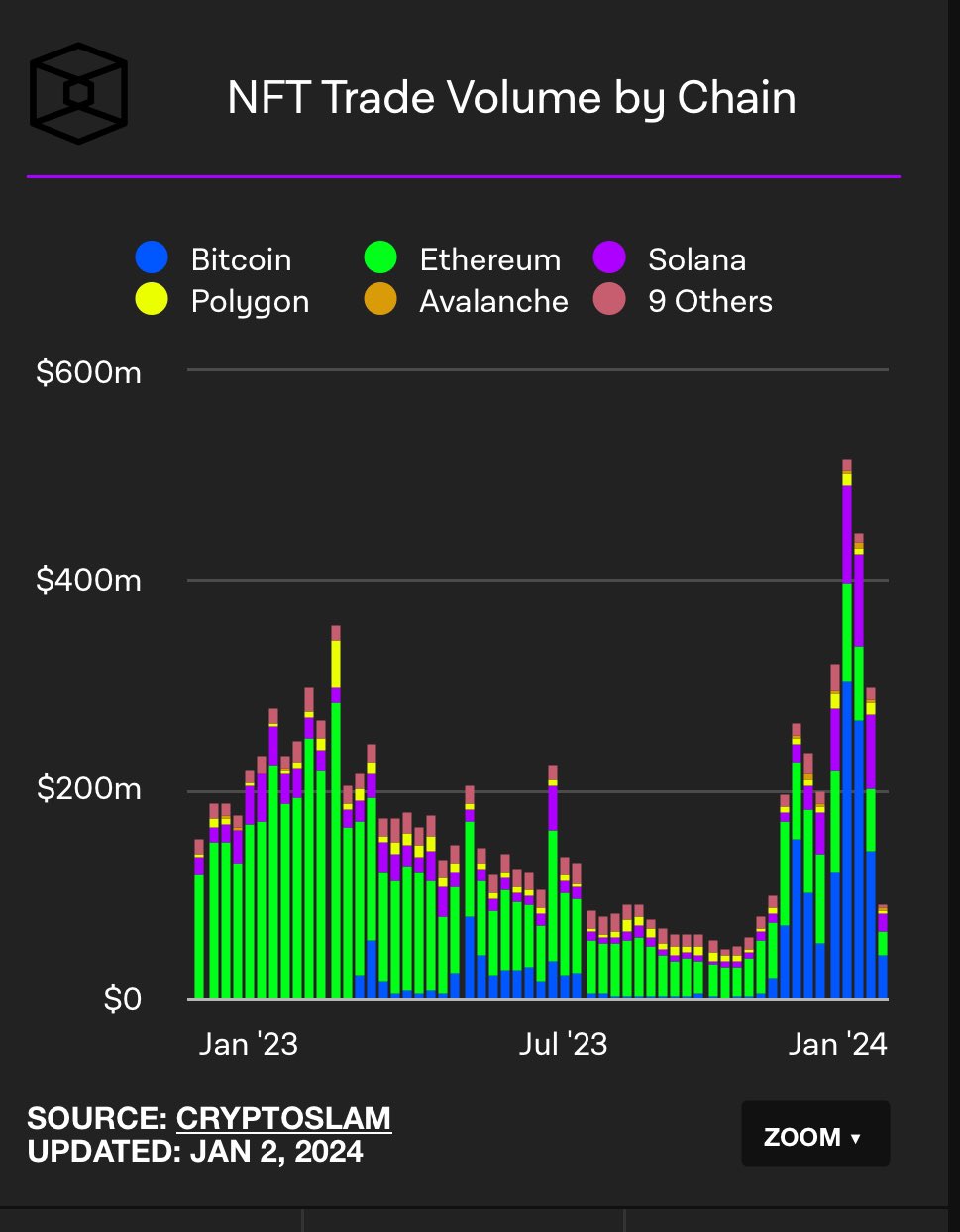

📊Charts of the Week

🤩 This Week on Crypto Twitter

Good question

— James Seyffart (@JSeyff) January 6, 2024

1) Ark withdraws with assurances about March (unlikely)

2) Genz goes nuclear & SEC denies using new reasons or ignores the court knowing they’d end up back in court (again--Unlikely)

3) Biden admin comes down and does something to stop this (unlikely) https://t.co/KNX4e3AeI7

This piece "System" by RipCache sells for 19.69 ETH

— NFTstats.eth (@punk9059) January 2, 2024

Previous sale of this was for 4.2 ETH in August, 2022.

Another 1/1 from the collection "Cerberus" sold for 16.9 ETH almost exactly a year ago. pic.twitter.com/1SwDuAOWIH

Someone just sent Satoshi's genesis wallet $1.2 mil. in BTC.

— Jeremy Hogan (@attorneyjeremy1) January 7, 2024

Why?? The only thing that makes any sense is that the sender is flushing Satoshi out.

Under the new IRS rules, you have to report any receipt of crypto over $10k. So, Satoshi has to dox himself, OR break the law. pic.twitter.com/S4vBkSdX21

🚨 Follow us!

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.