Bitcoin’s halving cycle - What it means for your investment

How to use halving data to predict boom and bust cycles.

Bitcoin is a notoriously volatile asset, making it an intimidating investment for newcomers in the space. This month, bitcoin plunged to $26, 292.60 before bouncing back to $29, 747.46 in the same day. Despite the unpredictable nature of short term price fluctuations, examining long-term trends can provide investors with a more coherent understanding of future price direction. In this article, we focus on bitcoin’s halving cycle and how investors can apply this knowledge to predict the rise and fall of bitcoin’s price. Similar to Plan B’s Stock to Flow model, a historical price analysis of bitcoin in relation to its halving cycle reveals a fundamental pattern that can be directly applied to future halvings and price trajectories. N+1 researchers began tracking this model in 2018 and used it to predict bitcoin’s cycle bottom in May 2019.

Halving prevents oversupply and curbs inflation

Halving is a computational approach to manage bitcoin supply and curb inflation. Approximately every four years, the reward given to bitcoin miners is halved, doubling the cost of bitcoin mining. Without halving, technological progress, lower production cost and competition would lead to surplus supply, driving down the price of bitcoin. Adjustments in mining difficulty coupled with halving prevent oversupply and sustain market equilibrium.

Despite bitcoin’s inherent sensitivity to public discourse, the largest and most constant factor shaping bitcoin price is the sale of bitcoin by miners to meet the cost of production. When the price of bitcoin increases, miners need to sell less bitcoin every month to meet the cost of electricity, mining rigs, among others. Miners’ selling less bitcoin decreases the supply of bitcoin, and hence increases its price. Conversely, when the price of bitcoin falls, miners need to sell more bitcoin to meet their costs. More bitcoin in the market leads to a further drop in price.

Hashrate and cost of production triggers bear and bull cycles

In addition, for a proof-of-work cryptocurrency like bitcoin, hashrate plays a significant role in supply and demand. Hashrate measures the total computational power used in the mining process. As hashrate increases, so does mining difficulty. As hashrate falls, difficulty decreases. When bitcoin price is high, there will be an excess of marginal miners - those miners with less staying power due to lack of experience, efficient rigs, among others. An excess of miners increases the hashrate triggering a game of theoretical chicken between miners. Established and efficient miners will continue mining, pressuring marginal miners who are less likely to survive a bust cycle to drop out. Experienced and efficient miners understand that difficulty will eventually decrease and will sell their bitcoin reserves to further decrease price, leading to miner capitulation.

The interplay between hashrate and cost of production creates a positive feedback loop that triggers bear and bull market cycles. Bull markets begin to take shape a year before halving as the last marginal miners from the previous cycle capitulate and leave the market. The more efficient miners that have won the game of chicken decrease their selling of bitcoin as prices rise which in turn further increases the price of bitcoin. Anticipation of this price dynamic creates a self reinforcing loop of rising prices. Conversely, once the price of bitcoin reaches extreme levels above the current costs of the hashrate, marginal miners begin to enter the space laying the seeds for the next cycle of boom and bust. From the bitcoin halving model, we can see a pattern emerge that is inherent to the cryptocurrency’s architecture.

Halving Cycle Updated May 2022 by nplus1data on TradingView.com

The X axis represents time and the Y axis represent price

- The orange vertical lines represent one year before halving.

- The green vertical lines represent bitcoin halving dates

- The red line represents all time highs for each halving cycle

November 2012 marks the first bitcoin halving. Miner reward dropped from 50 BTC to 25 BTC for each block mined. In November 2011, the bull market began to take shape as bitcoin closed at $3.19 that month and climbed to $1163.00 by November 2013.

The second bitcoin halving from 25 to 12.5 BTC in July 2016 follows the same pattern. The bull market began in July 2015 and bitcoin’s price was $284.33. It reached an all time high of $19,666.00 in December 2017 before dropping off.

The last bitcoin halving was in May 2020, where miner reward became 12.5 BTC per block mined. In this halving cycle, the bull market once again began a year previous and closed at $8547.20 in May 2019 and reached a high of $69,000.00 in November 2021.

Bitcoin is currently priced at $29,377.81 as of May 24, 2022. Considering the timing of the last two peaks in 2017 and 2013 from the halving, it appears the bull run is over. Past price activity suggests Bitcoin peaked on November 10, 2021 at $69,000 signalling the beginning of a new bear market. Moreover, our research suggests the new bull market will begin one year before the halving with a potential front run of 4-5 months, approximately January 2023.

This bitcoin halving and price model was originally created by N+1 Analytics researchers in 2018. We predicted that bitcoin would bottom in May 2019, one year before the May 2020 cycle. Bitcoin investors have begun to front run the cycle, and the market bottomed five months earlier in January 2019. In future cycles, we can expect an earlier bottom as investors front run the bitcoin halving price cycle.

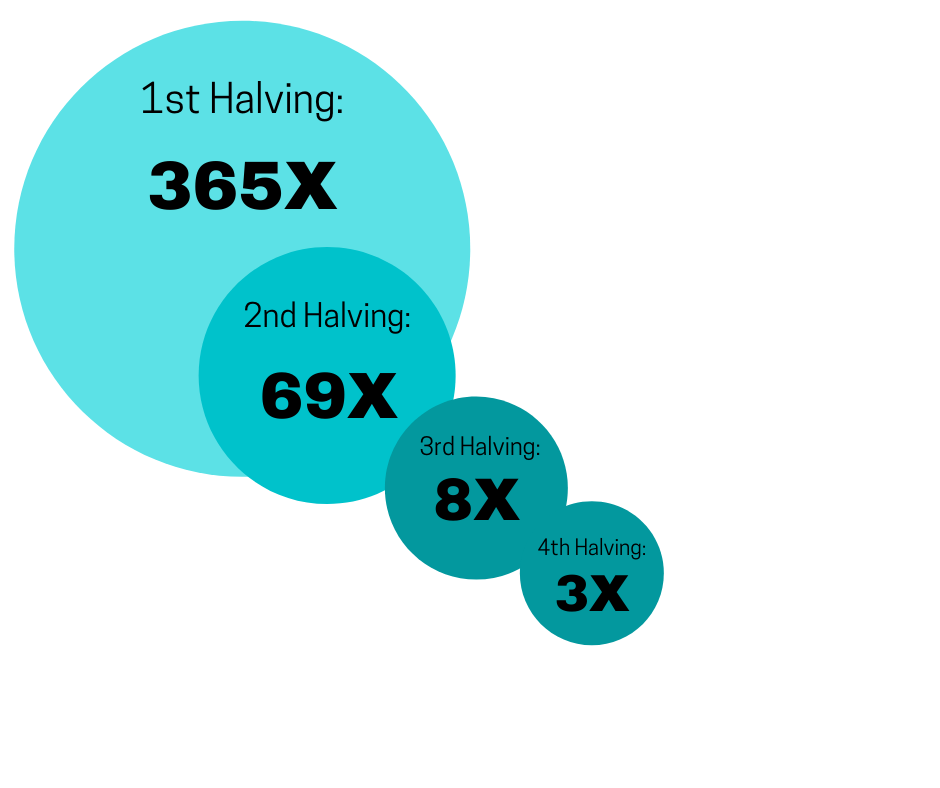

- 1st halving $3.19 to $1163

- 2nd halving $284.33 to $19,666

- 3rd halving $8547 to $69,000

- 4th halving prediction between 3-4X increase

As the halving analysis is well known by now and anticipated by traders, it is our conjecture that this effect may diminish in the future. Furthermore as the amount of money required to move the price increases, the return may decrease too.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.