BlackRock’s Ethereum ETF Hits $1 Billion

In this edition, we explore Binance money laundering claims, BlackRock’s spot ETF, PIP labs latest fundraising round and more.

Celebrating Our 100th Edition 🎉

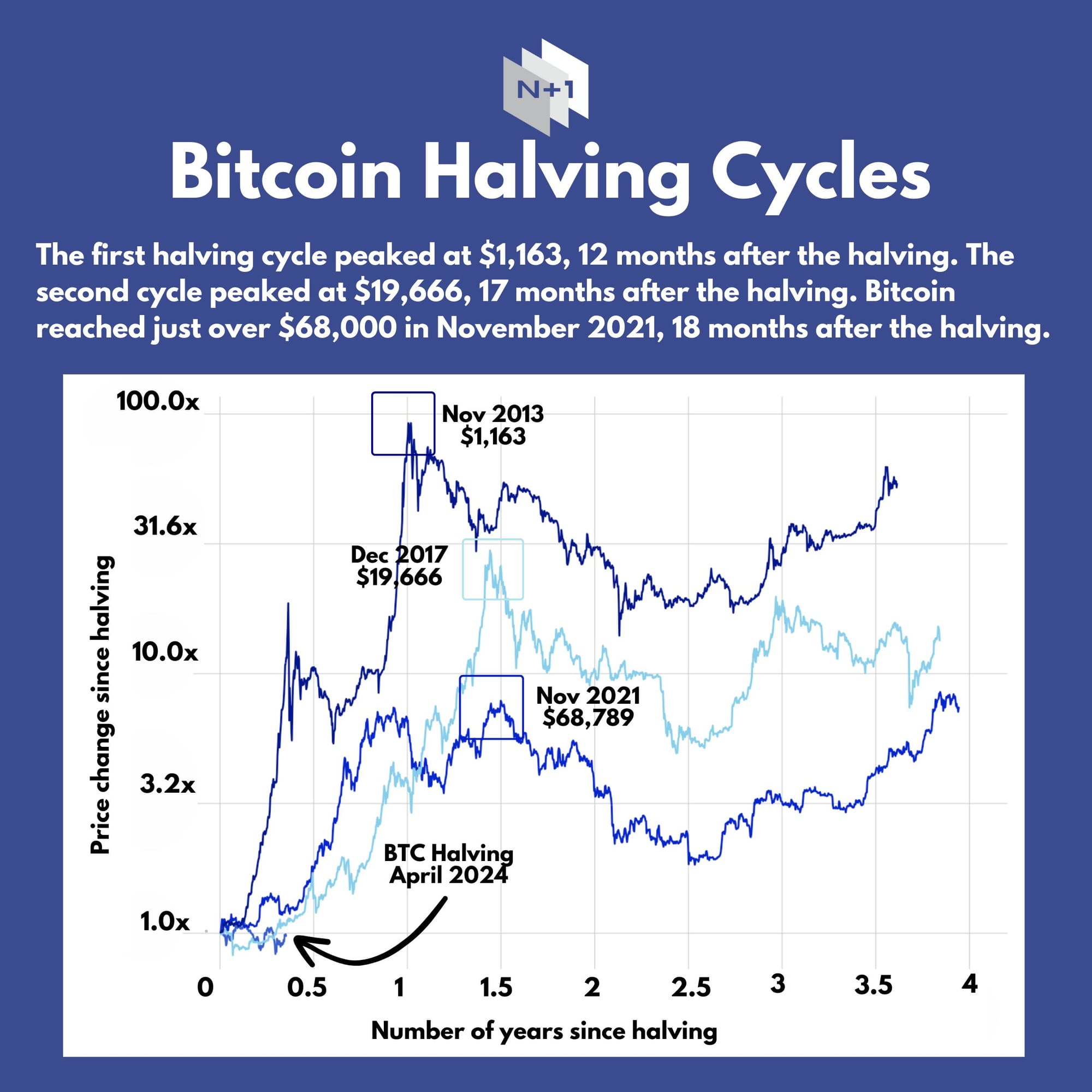

Read more: Having Cycle, Dollar Milkshake Theory, Spot Bitcoin ETF, Dencun Upgrade, Halving Countdown

💥 Cutting Edge with Shoal Research

In collaboration with Shoal Research, this week’s edition will focus on the MakerDAO rebrand.

What is it? MakerDAO is a decentralized autonomous organization operating on the Ethereum blockchain. It manages the Dai (DAI) stablecoin, which is algorithmically pegged to the US dollar. MakerDAO was one of the earliest DeFi projects and remains a key player in decentralized finance.

What does it do? MakerDAO enables users to lock up collateral in smart contracts to mint Dai, a stablecoin that can be used for trading, lending, or as a hedge against volatility. The system is governed by MKR token holders, who vote on proposals affecting the protocol, including the stability fee (interest rate) and types of collateral accepted.

What does it mean? MakerDAO represents a pivotal development in DeFi by providing a decentralized, stable currency (Dai) that can be used across various platforms. The project is foundational to the DeFi ecosystem, allowing for a variety of financial activities like lending, borrowing, and trading to be conducted without intermediaries.

Why is it interesting? The upcoming rebranding of MakerDAO to Sky Protocol and the launch of a new stablecoin, USDS, signal a significant evolution in the project. This move could expand MakerDAO’s influence in the DeFi space by introducing new features and capabilities, potentially attracting more users and increasing its market share.

Check out Shoal Research’s Substack and Telegram channel.

💡 Coin Spotlight: The N+1 HODL

In this segment, we dive into the N+1 Hodl basket and discuss our altcoins.

Coin: Axelar ($AXL)

Sector: AI, Storage

Fundamentals: Axelar is a Web3 interoperability platform. They allow cross-chain communication by connecting one blockchain to another.

Narrative: With "a single click to use and build everywhere", Axelar frames itself as unifying blockchains. Axelar has some strong use cases including J.P.Morgan's Onyx and Uniswap.

Why do we hold: Axelar's role in connecting blockchains is an important step to creating a unified and seamless experience in the crypto space.

Performance: AXL is down 53.84% YTD.

⏰ Crypto News Recap

Keep up to date with the latest in crypto.

Binance Money Laundering Claims

Both Binance and Changpeng Zhao face another lawsuit. Crypto investors Philip Martin, Natalie Tang and Yatin Khanna have filed a lawsuit alleging negligent compliance practices. The three argue that as a result of the alleged negligence, their stolen crypto was able to be laundered through the platform.

BlackRock’s Ethereum ETF

Of 11 US spot Ether ETFs, Blackrock became the first of the U.S. Ethereum ETFs to surpass $1 billion in net inflows on August 21st. BlackRock pulled ahead significantly in comparison to the others – with Fidelity sitting at the second highest net inflows at $367 million. BlackRock has also done well with its spot Bitcoin ETF, reaching the $1 billion marker after only four days of trading.

PIP Labs Raises $80 Million

PIP Labs, the company who created Story, recently wrapped up a successful Series B funding round. Story is an innovative blockchain protocol that tokenizes intellectual property. PIP Labs raised $29 million in its seed round and $25 million in its Series A round.

📚 N+1 Recommendations

The N+1 reading and media recommendations are sourced from our team of experts and offer weekly suggestions for learning more about blockchain, crypto, finance and technology.

This week’s recommendation: Countries Buy Bitcoin Worth $1 TRILLION?

📊 Charts of the Week

Curated charts from the N+1 team.

🚨 Follow us

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.