BTC and equities: One and the same?

No asset is safe from the economic slump as BTC, the S&P 500 and the Nasdaq become increasingly correlated.

Since the beginning of COVID-19 in March 2020, we have witnessed increasing correlation between crypto and traditional financial markets. COVID-19 fear triggered a crash in both equities and crypto markets, creating a strong correlation between the asset groups for the first time. Central banks and governments responded and COVID-19 stimulus quickly outpaced that of the 2008 financial crisis. Global money supply increased and this excess liquidity created sufficient conditions for financial and crypto markets to remain correlated during the price rebound, too.

Markets fall during economic uncertainty

Jump to today. We are creeping closer to a recession. U.S. inflation is at a 40 year high as COVID-19 and the war in Ukraine strain supply chains. In our last newsletters, we outlined the impact of the economic downturn on crypto and crypto exchanges. Bitcoin is currently down 60% since its November all-time-high.

Traditional markets are not faring well either. The S&P 500 fell 20% this year and Nasdaq dropped 28%, validating the correlation theory between traditional markets and BTC.

BTC no longer "digital gold"

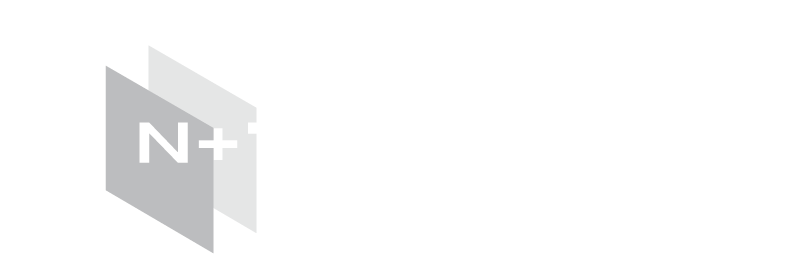

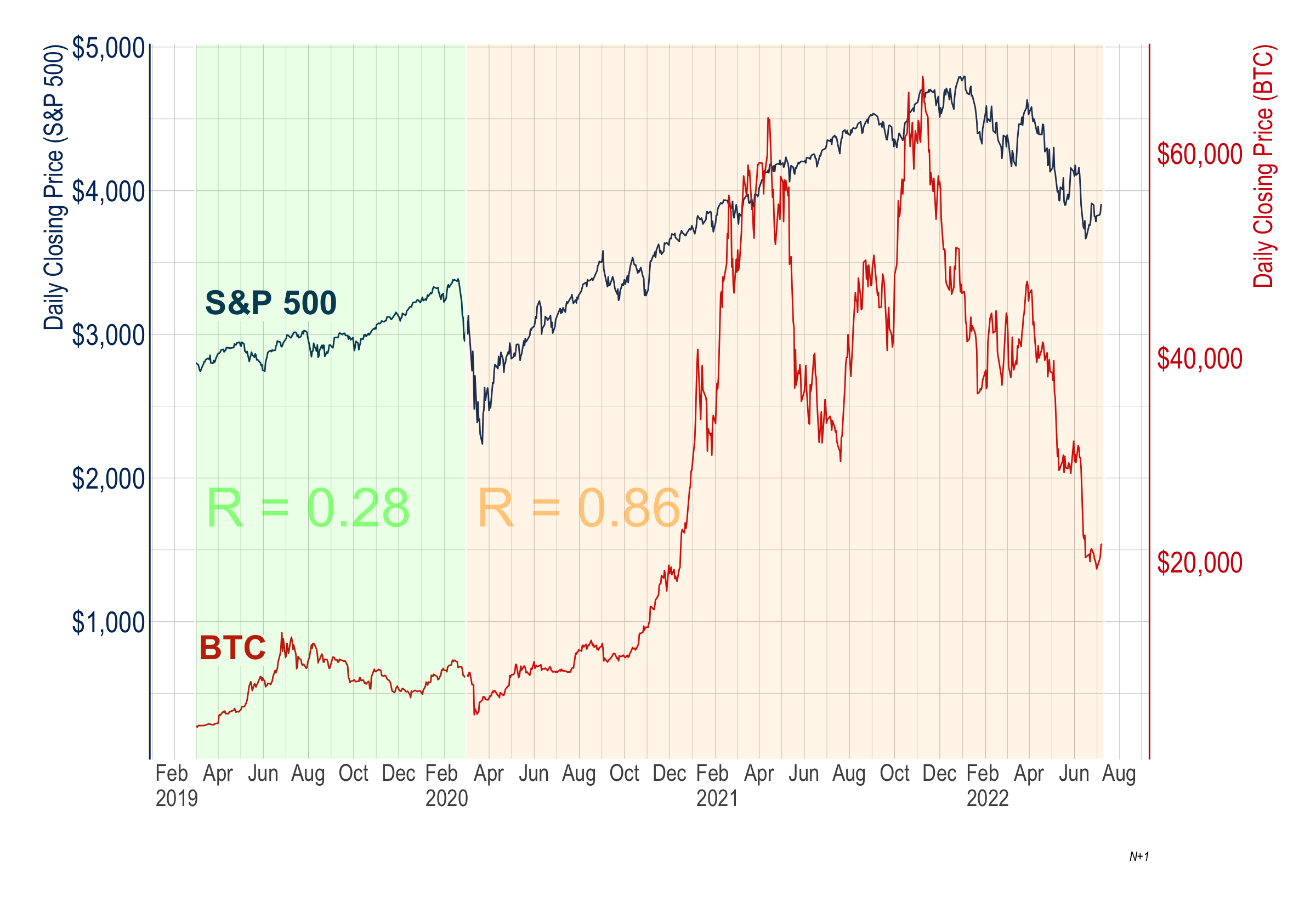

A perfect correlation coefficient is 1 and a coefficient of -1 means the two assets are moving inversely. Historically, bitcoin has maintained a relatively low correlation coefficient to other assets. Between January 2019 and January 2020, the coefficient between BTC and the S&P 500 was 0.28, when analyzing daily data. The year after, January 2020 to January 2021, it jumped to 0.78, indicating strong positive correlation between the two asset classes. As of July 2022, the correlation coefficient sits at 0.86 as the two assets near lockstep. BTC and the Nasdaq share a similar story. Correlation currently sits at 0.87, an all-time-high for the cryptocurrency and tech-focused stock exchange. This correlation reveals investors treat bitcoin as another tech asset, rather than digital gold.

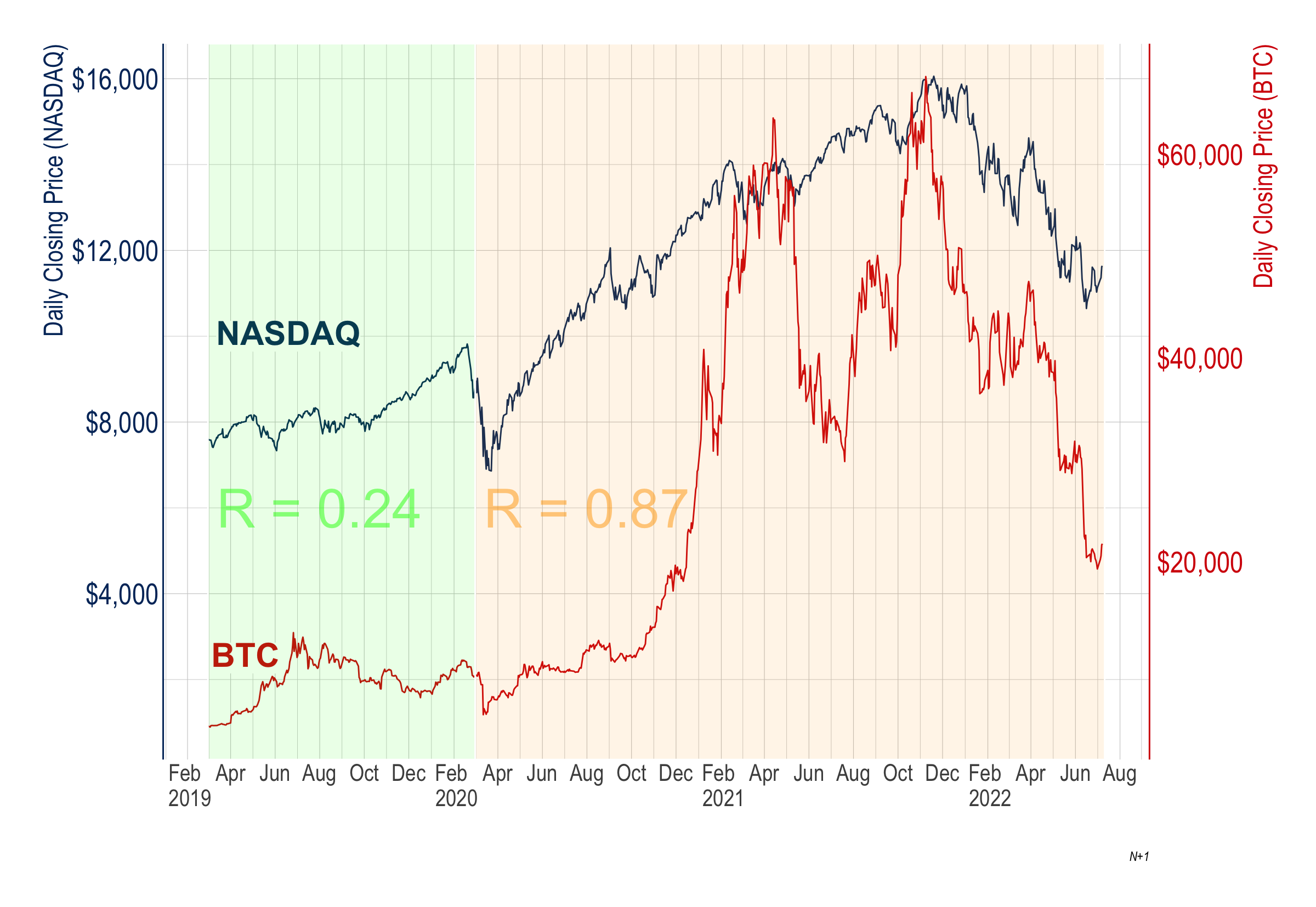

The last chart shows an interesting change in the relationship between BTC and the U.S. dollar. In the first period, the coefficient is positive and similar to the S&P 500 and the NASDAQ, at 0.32. However, the coefficient turns negative in the second period. While the relationship between BTC and the major U.S. equity markets strengthens, it reverses against USD to -0.29. The main reason for this is most likely due to the U.S. markets struggling while the U.S. dollar excels against the top foreign currencies. For example, the U.S. dollar and the euro are par for the first time in two decades.

Why are markets correlated?

With increasing market liquidity following COVID-19, bitcoin was perceived as a gold-like safe-haven — an inflation hedge. Its increasing presence in mainstream discourse solidified it as a legitimate asset class and institutional investment soared.

Big-name investors and institutions now have their hands in both traditional and crypto markets. Factors like the economic environment, investor sentiment and rising interest rates are impacting both equity and crypto markets equally. Rather than an inflation hedge, bitcoin and other cryptocurrencies are a relatively high-risk diversification option, similar to a tech stock.

What does this mean?

Some investors predict an eventual, “aggressive” decoupling between equities and BTC. However, as the Fed raises interest rates, equities have dropped followed by bitcoin soon after. Most likely, bitcoin’s price action will follow financial markets for the foreseeable future. Decoupling in short order is all but “hopium” for investors and crypto enthusiasts.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.