‘Crypto is a hotbed for crime’ and other common misconceptions

The truth behind common crypto claims echoed by mainstream media

Skepticism is normal with new technology and will eventually subside, says Dr. Ahmed Al-Rawi, Professor of Communication at Simon Fraser University. In addition, reputational attacks can be propagated by competitors like Wall Street and big banks as crypto vies with them for investments. Ultimately, many common narratives display a lack of understanding of crypto. Here are the most common misconceptions.

1. Crypto is a hotbed for crime and money laundering

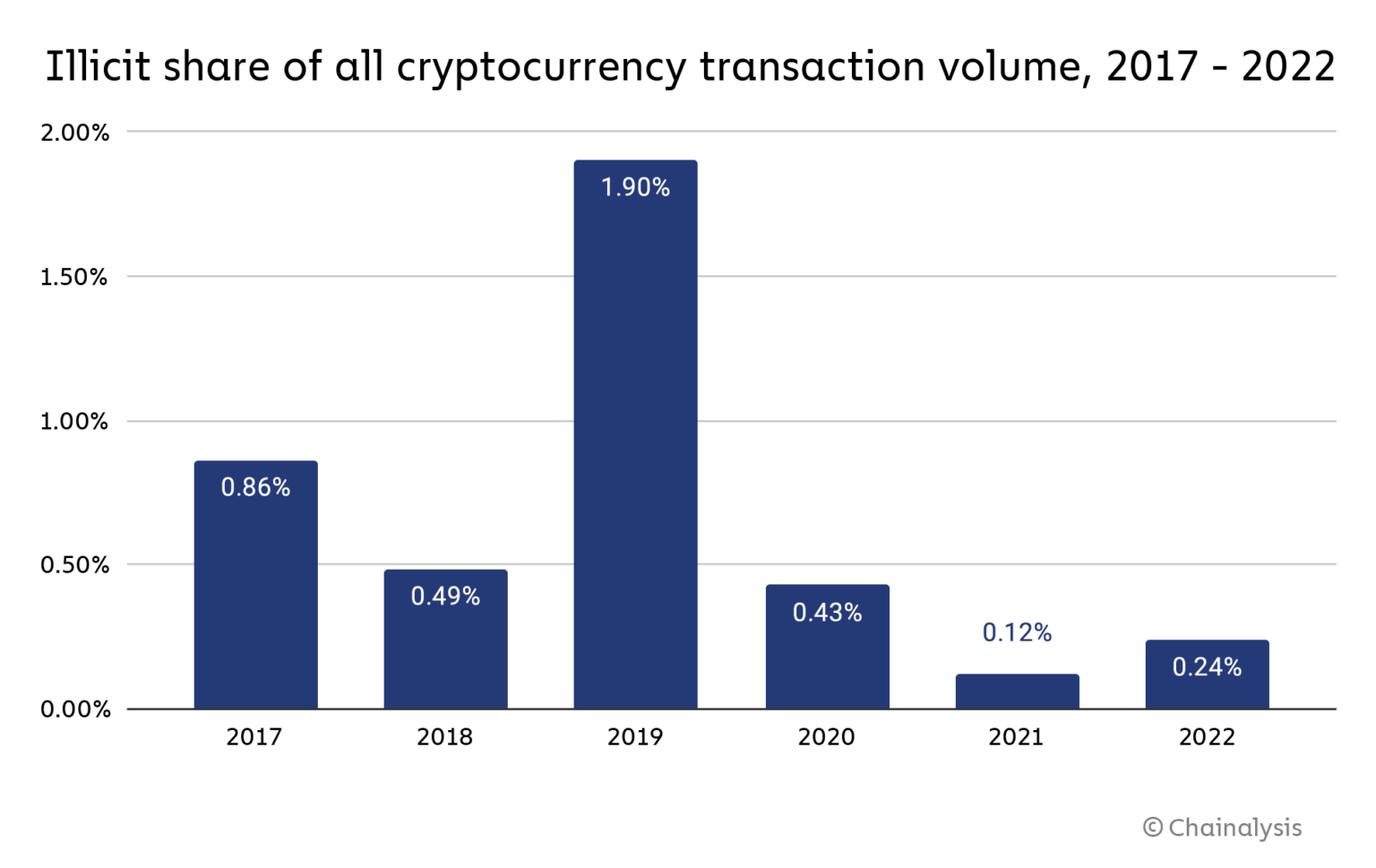

Yes, crypto is used for crime, as are fiat currencies, such as USD. Crypto is also used by many people, firms and governments for a wide range of legal and valuable activities. In 2020, 0.43% of crypto transaction volume came from illicit activity. In 2021, this number dropped to 0.12%. Last year, illicit transactions represented 0.24% of crypto transactions. In comparison, the UN reported 2-5% of fiat currency was used for illicit activities in 2020.

While crypto is known for its anonymity, authorities can actually trace transactions on public ledgers. In February 2022, the Feds arrested a New York couple for conspiracy to launder $4.5 billion in stolen cryptocurrency, demonstrating law enforcement's ability to “follow the money, no matter what form it takes.”

2. Crypto is made up and holds no real-world value

The reason traditional currencies, like USD, have value is because we collectively agree that they have value and utility – it is a shared fiction. The reason our financial systems function is because we agree to exchange goods and services for USD in addition to being legitimized through law.

As seen with recent bank closures, when a group of people decide they no longer have faith in a system, it can collapse. Our financial systems function, in part, because of a societal belief that fiat holds value. Crypto is no different.

Crypto is designed to have no central power and offers an alternative to the government-centric banking systems. For now, crypto is valued by enough people that the total market cap currently sits at $1.17 Trillion USD.

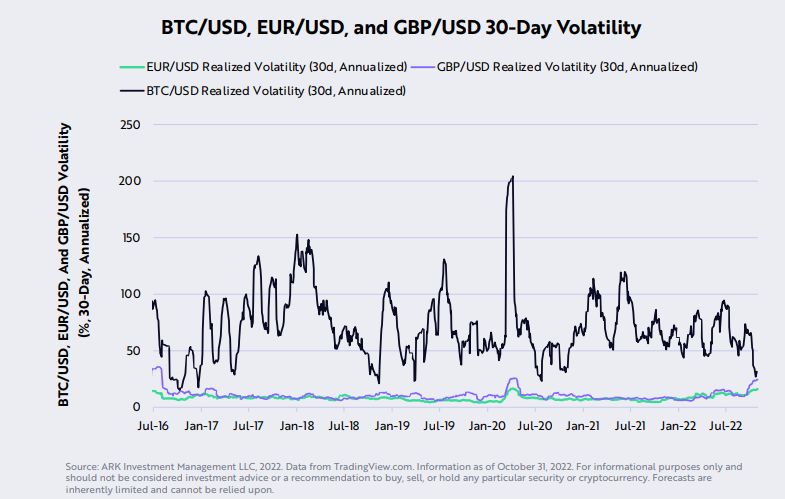

3. Crypto is so volatile, it is just a form of gambling

Crypto is not the first asset to be considered a gamble. Cynics have compared investing in the stock market as a gamble long before crypto was created. Crypto is notoriously volatile and price fluctuations can be caused by supply and demand, investor and user sentiment, government regulations and media hype.

While investing in cryptocurrency may be high risk, it is unlike gambling because the outcome is not left up to chance. If you are an informed, strategic investor, crypto can be a valuable way to diversify your investment portfolio. When uninformed investors purchase crypto with money they cannot afford to lose in the hopes of getting rich quick, then it can become a personal gamble.

4. Cryptos are hacks, ponzi schemes and scams

Crypto has seen plenty of hacks, ponzi schemes and scams due to bad actors in the space. However, scams and hacks exist in both traditional finance and technology industries and do not reflect crypto inherently. The recent fall of well-known crypto exchanges played out in a similar fashion to Long Term Capital Management’s colossal failure in the 90s. It is not a crypto problem, it’s a greed problem.

Crypto can be safe if you do your own research, use cold wallets and think critically about available information. As the space develops, there will be an increase in regulation, improvement in technology and wider education on good practices which will help mitigate risks.

5. Crypto is destroying the environment

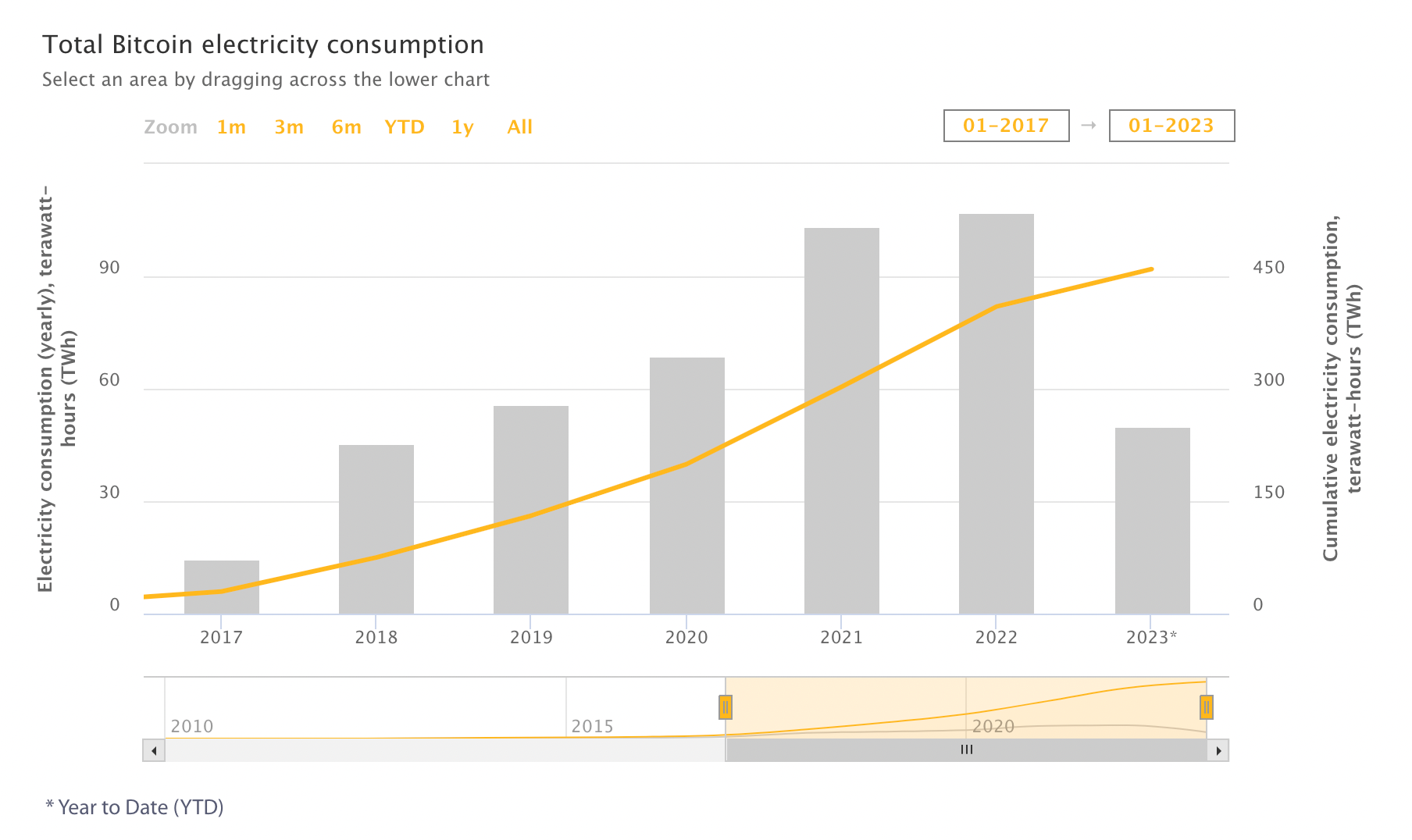

Another common misconception is that crypto is destroying the environment. As discussed in our Insight on crypto and the environment, the issue at hand is not crypto’s energy use but the perceived worth of the technology.

Crypto is highly critiqued while banking systems, the U.S. dollar and streaming platforms are no better on an environmental scale. Further, Bitcoin’s energy use is lower than the mining of copper and zinc, the world’s residential air conditioning systems and data centers.

Thus, crypto is often the target of energy use criticism when in reality, other systems already in use are damaging. Ultimately, a critique of our systems as a whole would be much more beneficial.

Cryptocurrency is an innovative, burgeoning technology which makes it vulnerable to misinformation carried out by mainstream media, social media threads and institutions that see crypto as a threat. While some may perceive crypto as a hotbed for crime, scams, volatility and environmental degradation, these claims can be easily refuted by seeking out accurate and unbiased information on crypto markets.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.