Crypto tangled up in U.S. banking crisis

Regulators force the closure of three banks with deep ties to crypto

The collapse of three key banks have shaken the cryptocurrency industry. In this Insight, we explain what happened, what it means for crypto in the U.S., and explore Operation Chokepoint 2.0.

What happened?

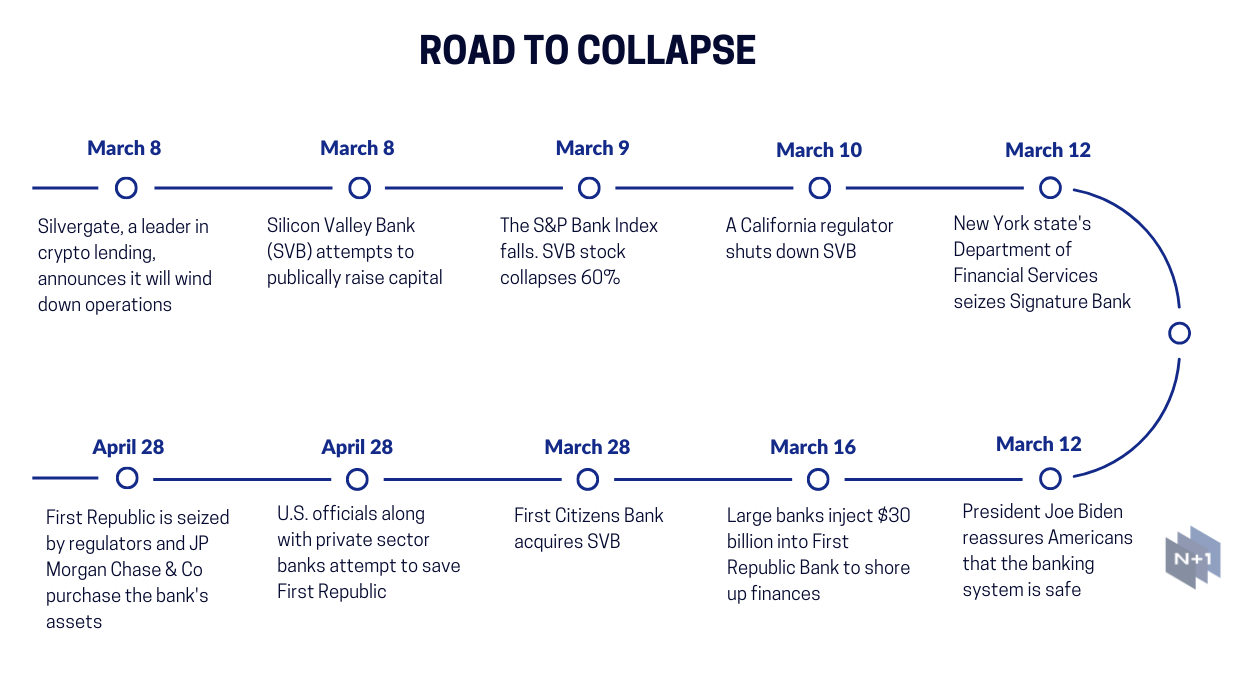

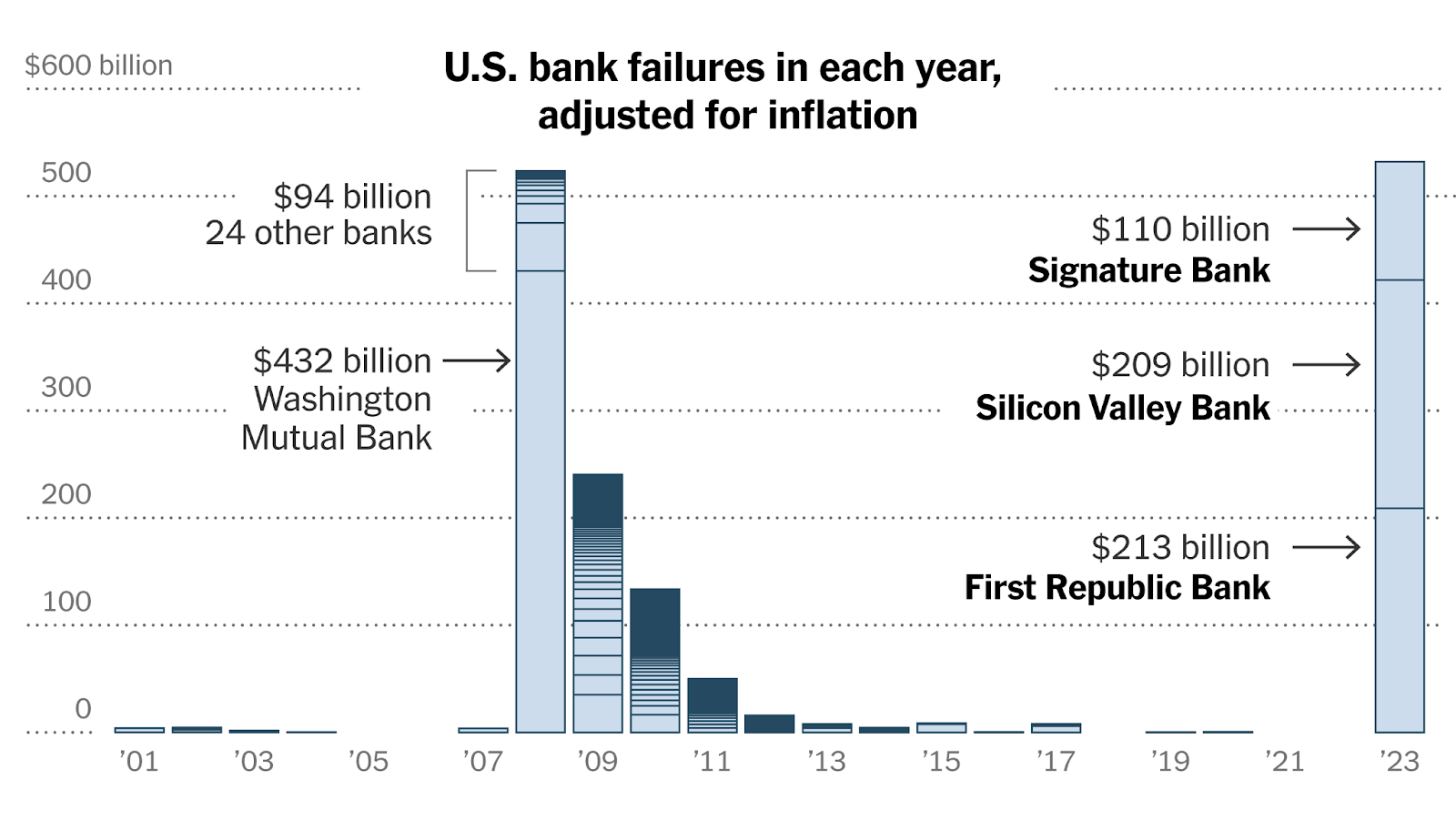

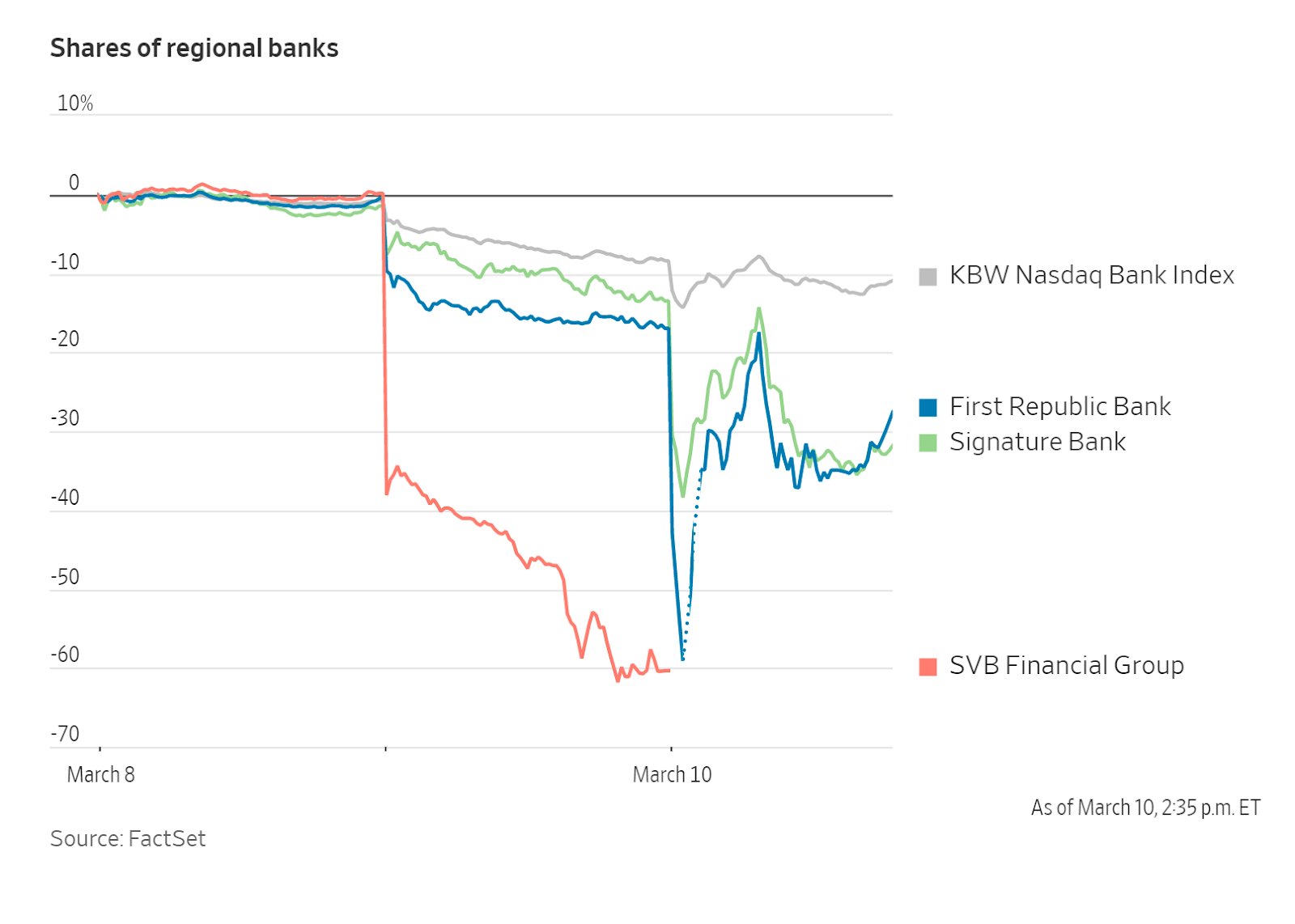

In the span of 5 days in March, the U.S. experienced three bank closures. A month later, First Republic was seized by the FDIC and JP Morgan is now set to purchase most of the San-Francisco lender’s assets. In response to these banking failures, stocks are tumbling for a number of regional banks along with the KBW Regional Banking Index.

Silvergate winding down operations

On March 8th 2023, the California-based bank, Silvergate, announced its intent to wind down operations. In its announcement, the bank cited industry and regulatory developments for its voluntary liquidation. This comes at the heels of FTX’s collapse, which was a client at the bank.

The year leading up to Silvergates’s closure saw a major downturn in global markets. Due to rising interest rates in the U.S. there was a decline in capital and slowing of the economy. In January of 2023, Silvergate reported a net loss of $1 billion in the fourth quarter, alongside 40% layoffs.

Silicon Valley Bank collapse

Silicon Valley Bank (SVB) was the 16th largest bank in the U.S. Headquartered in California, the Silicon Valley tech industry made up a large part of its client base. SVB was also known as a crypto friendly bank who serviced many blockchain companies.

The March 10th shutdown by federal regulators was due to a series of events. Rising inflation caused the value of SVB’s treasury bonds to decline, which led the bank to publically attempt to raise capital. This announcement spooked depositors which led to a bank run on March 10th as clients withdrew around $42 billion. At the time, SVB’s closure was the second largest bank failure in U.S. history.

Signature seized by regulators

On March 12th, two days after the SVB’s shut down, regulators abruptly closed Signature Bank. Headquartered in New York City, Signature was the 19th largest bank in the U.S. Reportedly, Signature clients withdrew $10 billion after the collapse of SVB and the shutdown was to prevent contagion among the banks.

Signature also had a close relationship with crypto. They offered a product called Signet, which was a real-time crypto payment network. Signature’s failure generated buzz among the crypto community. A Signature board member and former U.S. Congressman, Barney Frank, criticized the decision. He argued that the decision was meant to send an anti crypto message and said the regulators did not have enough reason to close Signature.

What does this mean for crypto companies?

The closures of three crypto banks had immediate impacts in the crypto world as many companies were left without access to traditional finance. Other impacts included USDC temporarily depegging and rumours of a coordinated effort to unbank crypto.

Further, there were reports that the FDIC instructed buyers of Signature to give up all crypto business. A FDIC spokesperson has denied this. However, when Signature was sold to the New York Community Bancorp, the sale excluded $4 billion worth of crypto-related deposits. This cumulation of events mean less banks available for crypto and a general fear towards banks doing business in the crypto space.

Operation Choke Point 2.0

As discussed in our last Insight, the crackdown on crypto is commonly referred to as Operation Choke Point 2.0. Operation Choke Point 1.0 was an initiative by federal bank regulators which consisted of coordinated, intentional actions to dictate who was able to do business with banks. Cooper and Kirk, the firm who successfully challenged the original Operation Choke Point, recently released a paper outlining Operation Choke Point 2.0.

Tom Emmer, a congressman and attorney, recently sent a letter to FDIC claiming that the regulator’s actions display a coordinated attack against crypto. Three members of the House of Representatives joined Emmer on April 26th by writing their own letter to the FDIC demanding further information on the bank regulator’s actions.

Cryptocurrency is inextricably intertwined with traditional finances. If Operation Choke Point 2.0 is successful, it could have lasting impacts on the crypto market in the U.S. However, as there is extensive pushback against this initiative, it remains to be seen how it will unfold. In addition, despite the recent collapse of these banks, a number of crypto friendly financial services remain.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.