Canada Tackles Crypto Regulation

In this edition, we explore the Paxos' investigation, Crypto.com memecoins, LiquiTrade registration and more.

💥 Cutting Edge with Shoal Research

In collaboration with Shoal Research, this week’s special feature will dive into Artificial Superintelligence Alliance (ASI).

What is it? The Artificial Superintelligence Alliance (ASI) is a consortium formed by the merger of three prominent decentralized AI companies: SingularityNET, Fetch.ai, and Ocean Protocol. This alliance aims to advance the development and deployment of artificial intelligence (AI) technologies through a decentralized framework.

What does it do? ASI facilitates the development and integration of advanced AI technologies by leveraging the collective expertise and resources of its founding members. The alliance focuses on creating a unified token, ASI, which streamlines interactions and transactions within the AI ecosystem. ASI provides DApp tools and a migration platform to ensure seamless transition and integration of existing technologies and tokens into the new framework.

Why is it interesting? ASI represents a significant advancement in the integration of blockchain technology with AI development. This merger not only enhances the potential for technological innovation but also creates a robust and scalable framework for AI development. The introduction of the ASI token and migration tools further underscores the alliance's commitment to creating a seamless and integrated AI ecosystem.

Check out Shoal Research’s Substack and Telegram channel.

💡 Coin Spotlight: The N+1 HODL

In this segment, we dive into the N+1 Hodl basket and discuss our altcoins.

Coin: Bittensor ($TAO)

Sector: AI

Narrative: The Bittensor ecosystem is dedicated to the “production, marketing and selling of digital commodities” where everything is decentralized. The project specifically focuses on decentralized machine learning, allowing participants to earn tokens through contributions to the network’s computational power.

Fundamentals: Bittensor is built on the Substrate framework and employs subnets. Subnets contain off-chain validators and miners that compete and support the ecosystem.

Why do we hold: Bittensor is an innovator in the AI machine learning space.

Performance: TAO is up 273% YTD (Source: CoinMarketCap).

⏰ Crypto News Recap

Paxos Investigation Concludes

Last Tuesday, Paxos announced they received a letter from the SEC stating that they will not conduct any enforcement action against the blockchain company. Paxos is a New York blockchain company with brokerage, asset tokenization and settlement services. The move comes a year after Paxos received a Wells notice, which usually warns of potential enforcement action. The notice was a part of the investigation into Binance USD due to Paxos’ collaboration with Binance.

“Paxos prevails in SEC investigation of BUSD stablecoin” 👏

— Paxos (@Paxos) July 11, 2024

On Tuesday, we received a formal termination notice from the SEC stating that it will not recommend enforcement action against Paxos Trust Company in the investigation of Binance USD (BUSD).

View the letter and our… pic.twitter.com/8kjysfsPg3

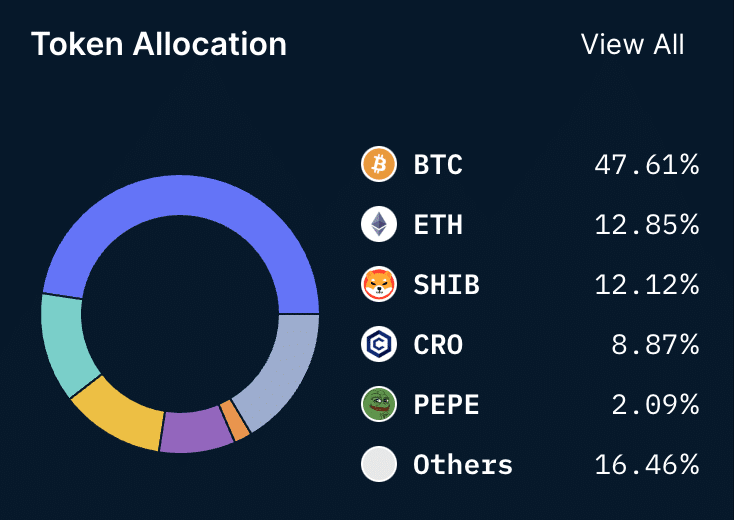

Memecoin Reserves on Crypto.com

Memecoins make up over 15% of Crypto.com reserves according to blockchain analytics firm Nansen. Nansen states that Crypto.com customers collectively hold more than $920 million in memecoins. $718 million of these holdings are dog coins.

Latoken and parent company LiquiTrade Registration in BC

A recent hearing for crypto exchange Latoken, owned by LiquiTrade, in British Columbia, Canada, reveals the levels of complexity governments deal with when considering the legality of crypto. According to a report, LiquiTrade failed to register for derivative trading in Canada and may face sanctions and fines as a result. According to the report, “Given that every unit of Bitcoin is treated, by its nature or by mercantile custom, as being equivalent to every other unit of Bitcoin (and the same applies to both Tether and Ethereum), units of Bitcoin fall within the definition of a commodity in the Act”. While the decision focuses on sanctions for derivative offerings, the defining of Bitcoin, Tether and Ethereum as commodities is highly notable. Regulators across the world have been slow to determine whether projects are commodities or securities. For example, the SEC and Commodity Futures Trading Commission (CFTC) in the U.S. have argued over who has jurisdiction without a clear outcome.

📚 N+1 Recommendations

The N+1 reading and media recommendations are sourced from our team of experts and offer weekly suggestions for learning more about blockchain, crypto, finance and technology.

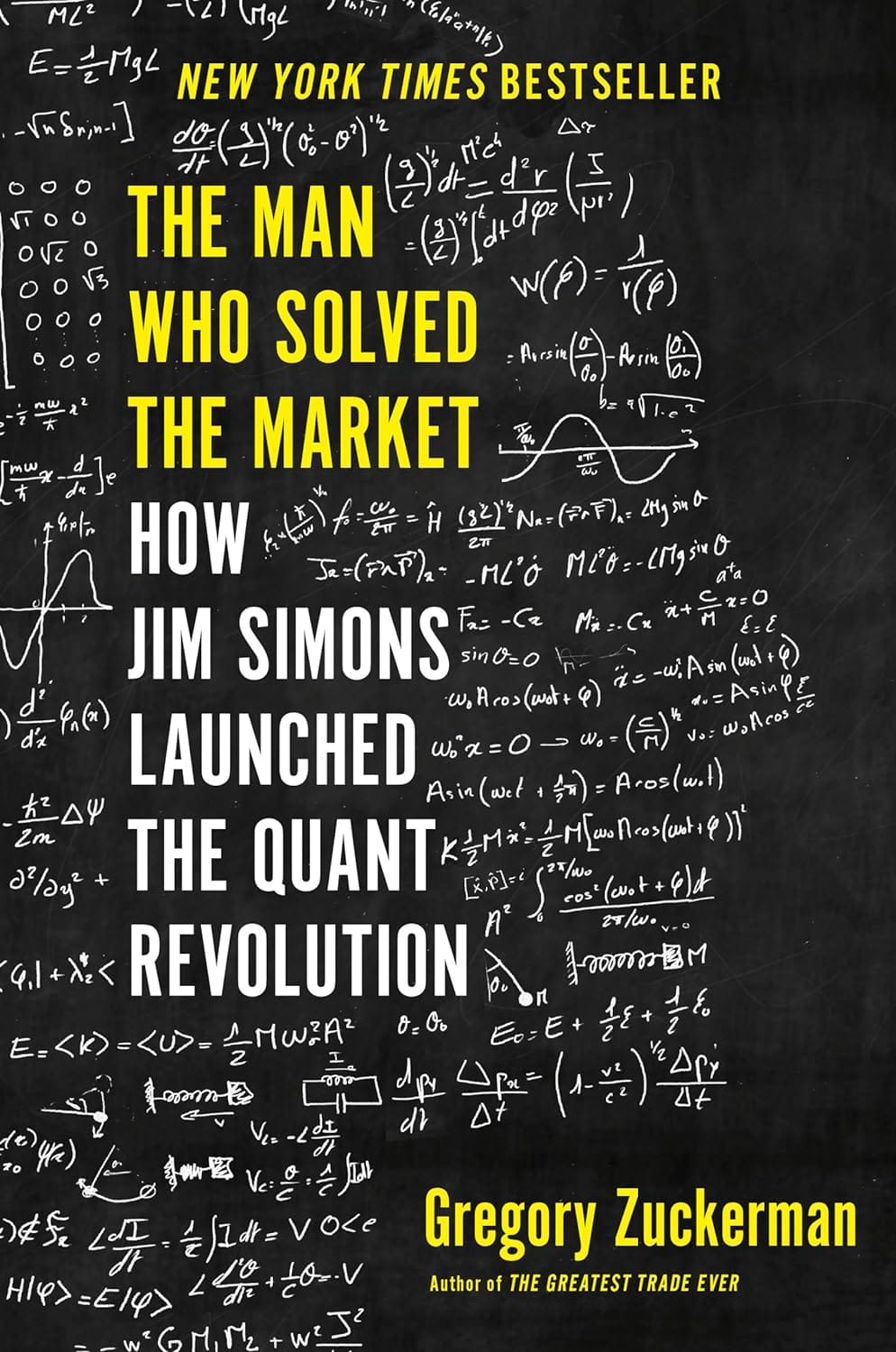

This weeks recommendation: The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution By Gregory Zuckerman

📊Charts of the Week

🚨 Follow us

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.